Stocktaking [home]

![]()

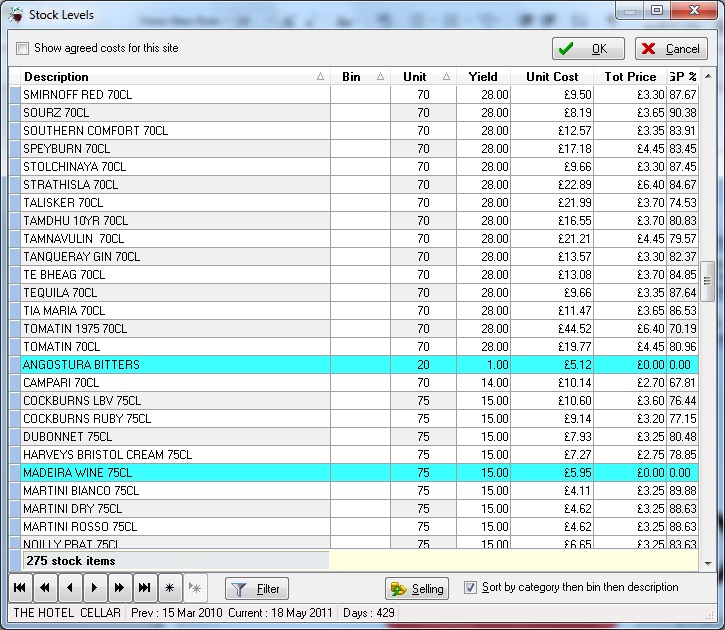

When all the required products have been added to the bar we can setup the unit cost price (ex vat), selling/tot price (inc vat) and yield for the product (you will also need to do this for any newly setup products). Any products that are missing information will be highlighted orange or blue.

It is best practice to review the stock levels screen just prior to rollover looking out for: any high/low/negative GPs, incorrect yields, orange or blue lines.

NOTE: any changes to this screen will affect the entire stock period - if selling prices change mid period Mid Price Change should be used, if cost prices change these should be updated through Purchases. Not updating costs through purchases will result in the wrong purchase price being used resulting and affect the GP.

Important: In a Multibar site, Selling prices must be entered into the cellar (as well as all other bars) to enable the correct calculations to be made in reports. Where selling prices vary, the highest tot price should be entered for the cellar.

Orange & yellow are used to denote items grouped in dozens.

Yield calculations are: unit total volume/one measure volume = number of theoretical sales from one unit

E.g.

| Product | Unit |

Measure |

Calculation |

Yield |

| Bacardi 1.5LT | MG |

25ml |

1500/25 |

60 |

| Martini Bianco 75CL | 75 |

50ml |

750/50 |

15 |

| Blossom Hill White 75CL | 75 |

750ml |

750/750 |

1 |

| Carlsberg Export GL | GL |

1 Pint or 568ml |

8/1 or 4546/568 |

8 |

| Budweiser 330ml | DZ |

1 bottle |

12/1 |

12 |

| Cranberry juice 1LT | LT |

284ml |

1000/284 |

3.52 |

Postmix calculations follow the same principal, however you must check the ratio mix and try to charge the same per fluid ounce accross all measures:

| Product | Unit |

Measure |

Calculation |

Yield |

| PM Coca Cola 5.4+1 | LT |

284ml |

(5.4+1)x1000/284 |

22.54 |

| PM Pepsi 5+1 | LT |

16Oz or 454.4 ml |

((5+1)x1000)/((16/20)x568) |

13.20 |

| PM Schweppes 7.5+1 | LT |

454.4ml |

(7.5+1)x1000/454.4 |

18.71 |

Mid price change should be used when a price tariff change takes place part way through a stock period. This function is not 100% accurate it estimates the number of sales at the old price and the number of sales at the new price based on total usage and days entered.

e.g. Keg prices have increased and we want to increase the selling price to prevent the GP from being lowered.

With a price tariff change, we will most commonly want to use the 'Days at old price' function as each product will have changed price on the same day. To do this:

- increase the days at old price to that required e.g. 10

- enter the new selling price

- the software then calculates the number of days sales and proportion of sales at the new price

NOTE:

When no selling 2 price is entered, the price is not altered.

The 'days at old price' field can be set manually if a price tariff change took affect over more than one day.

The result may not be accurate if large events have resulted in large quantites of different stock selling at different times of the month. The software will calculate the proportion of sales if sales are consistent throughout the month.

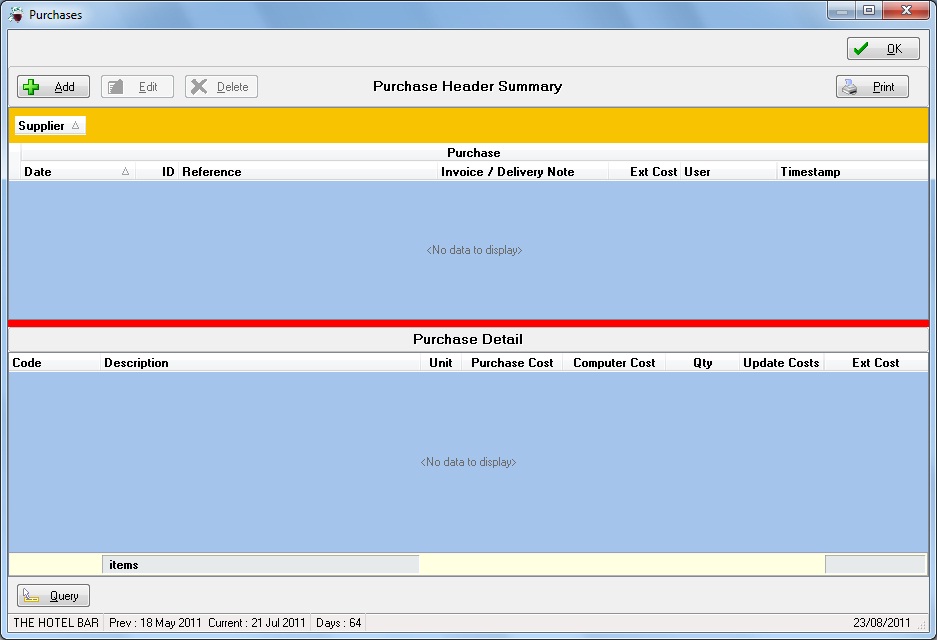

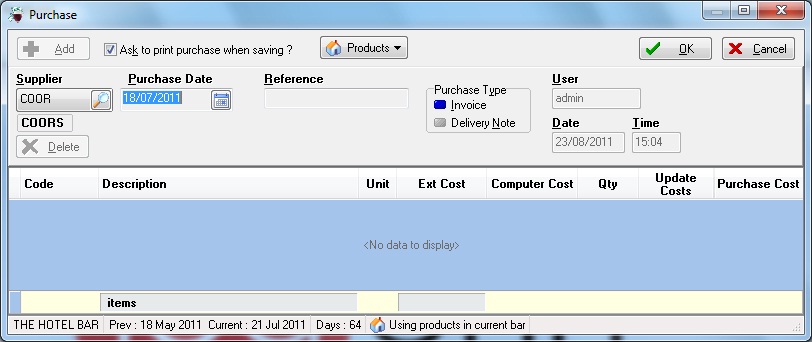

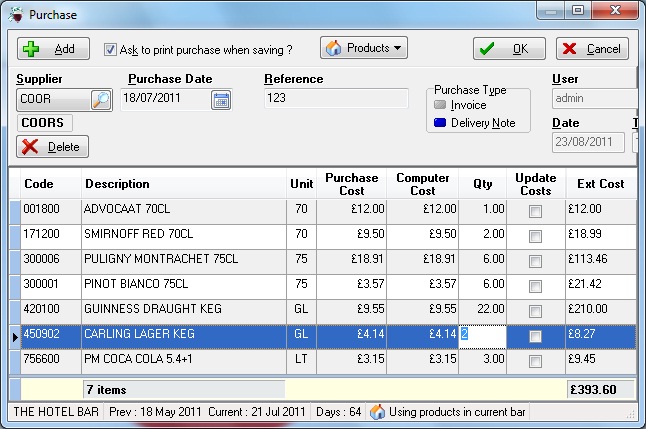

We have two types of purchase: Invoice - where the cost prices are known. Delivery note - Incase we have no invoice and the cost prices are unknown. To enter a purchase: Purchases button -> Add.

Select the supplier from the list, enter the purchase (delivery) date and reference number from the invoice. If any suppliers or products are not available, you will need to add these before proceeding.

Invoice

- Each line of the invoice should be entered seperately e.g. do not group together J2O products when entering a purchase

-

From the reference field, use either the Tab or Enter key (x3) to move to the bottom half of the screen.

-

Type in the first few characters of the product name to filter for the product and select

-

Enter the Ext cost (Extended cost is total cost excluding VAT)

-

Enter the quantity of unit received

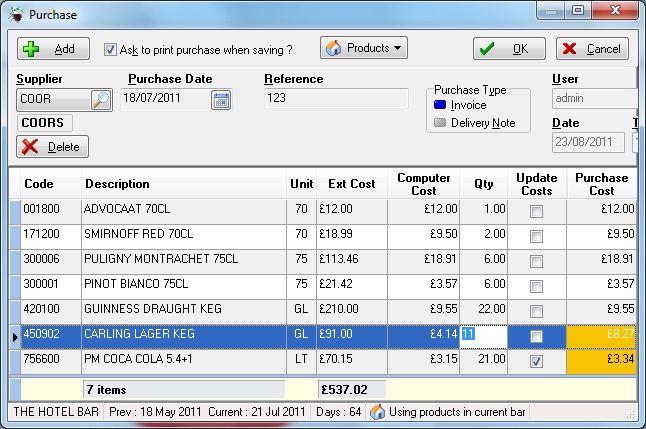

- When each line has been completed, you should look to see whether the purchase cost is orange – if it is you should check to see whether the price change is reasonable (e.g. £3.07 -> £3.17) or not (e.g. £3.07 -> £30.17 or -> £6.14). A large price change should be checked again against the invoice, when we have confirmed that this is correct, we should then tick ‘update costs’. When the purchase cost is grey no action should be taken.

- When all lines have been entered, ensure that the total price matches that of the invoice and that all products that have had price changes have been updated.

NOTE: Prices should not be updated from irregular suppliers e.g. petty cash. Ticking the update costs box for every line will not have a negative effect on the result if the data is correct however we risk not noticing errors when entering pruchases. If the cost has changed by a large amount you should look out for whether it is the correct product chosen, the correct total cost and the correct quantity (e.g. dozens commonly in multiples of two, draught in multiples of the number of gallons in a keg, Postmix in multiples of the number of litres in the bag.)

Delivery note

Should only be used when there is no invoice available before rollover.

You can change between invoice and delivery note as required and may want to enter a delivery note if processing an interim stock. It is better to enter an invoice as this allows you to update costs (calculating a more accurate GP and stock value) and makes it easier to spot errors.

- Each line of the delivery note should be entered seperately e.g. do not group together J2O products when entering a purchase

-

From the reference field, use either the Tab or Enter key (x3) to move to the bottom half of the screen.

-

Type in the first few characters of the product name to filter for the product and select

-

Enter only the quantity of unit received - the rest of the data is then assumed from the previous cost price.

|

Left we can see an example of an incorrect quantity entered either this time or last time and a purchase price update. |

|

Left (using a delivery note) it is more difficult to spot the quantity errors |

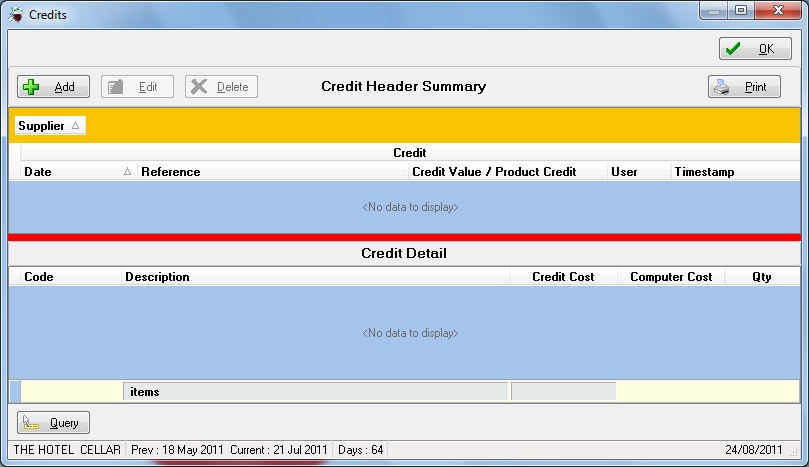

This is reverse process of a purchase. You can either enter a credit as a credit value (if you know the cost price) or as a product credit (if you know the quantity). This function can also be used to credit out stock that is transferred to another site (you also need to 'purchase' in the stock at the other site).

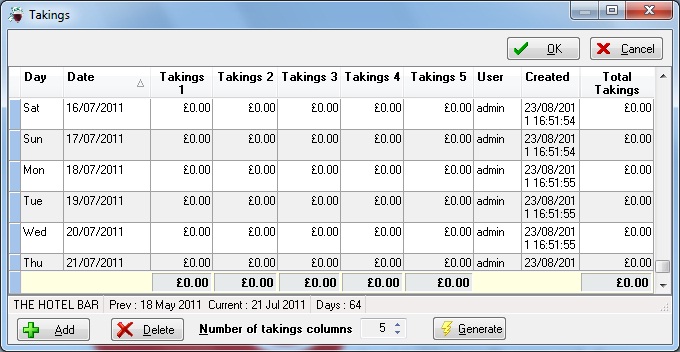

The takings entered should be inclusive of VAT, from the time when the stock was last counted until the time of this count and should ideally be entered daily. (eg if the stock is counted at 9am then the revenue later that day should not be included). The best way to enter revenue is to press 'Generate' which will create a date entry for every day of the stock period. By default there are five takings columns, the number of columns should be reduced if we have fewer takings areas.

You can also enter the data week by week in one lump sum or however you have the data available as long as it meets the previous criteria.

An allowance is an explanation of why the actual GP is less than the theoretical GP. The theoretical GP assumes that all stock is sold over the bar in the quantities received and at the normal price tariff. There can hence be many different complex reasons for allowances, you may wish to use the allowance calculator.

When entering an allowance select Add -> Enter the date (enter exact date if available, otherwise any date within the period) -> Select Allowance type -> Amount (the amount of revenue not being received including VAT) -> Extra information (why/the breakdown)

e.g. If a bar has a 3 4 2 offer on glasses of Wine, the bottle retails at £11.95 and a large glass of wine retails at £4.00 then only £8.00/£11.95 revenue is received. The allowance is the difference i.e. £3.95 per bottle sold

Different sites have different allowances permitted, always check what is permitted.

To see a tutorial, click here

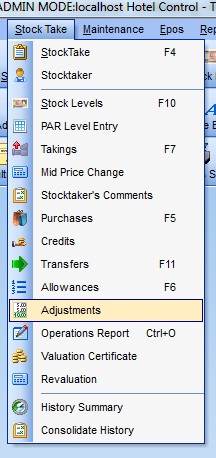

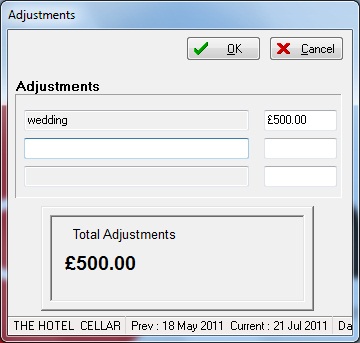

An adjustment is the opposite of an allowance and is an explanation of why there is more revenue than expected and as a result the actual GP is higher than the theoretical GP.

E.g. a wedding package including room hire, food, drinks with 50 x guests at £39.95 each is £2497.50

The expected revenue per drinks package is £15pp however £20pp is allocated along with £250 from the room hire

We should enter an adjustment for the extra £500.

E.g. 210 x 250ml wine @ £5.00 vs 70 x 750ml wine @ £12.00 = £210 adjustment

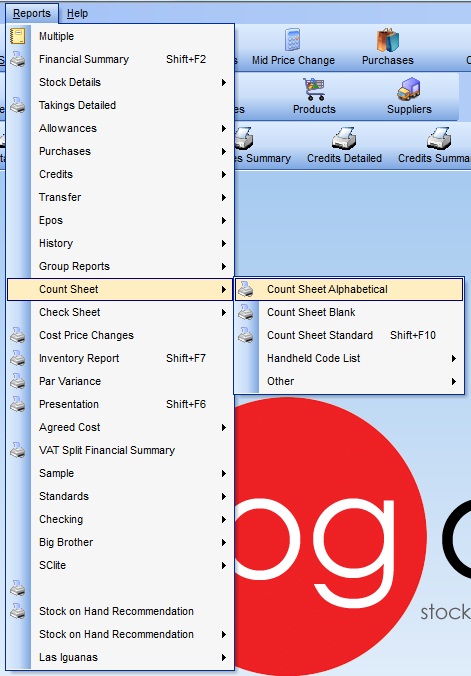

Before counting the stock, you should print off the count sheets from the software. There are several different types of count sheet, you may wish to review them to choose the most suitable one.

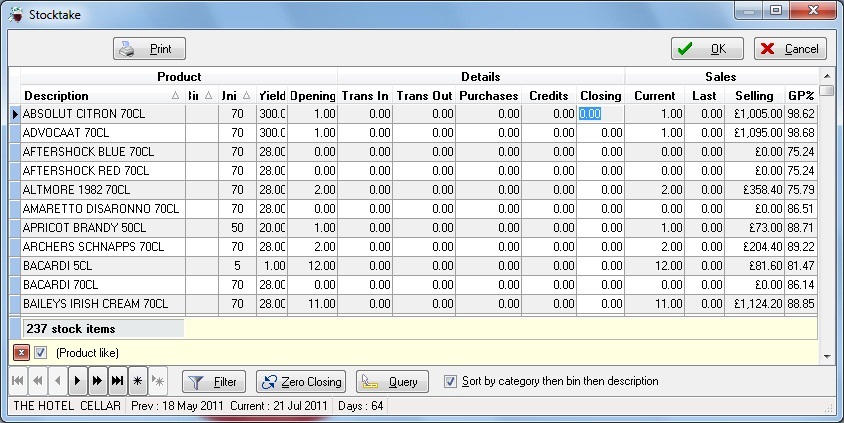

When the count has been completed and totalled up on paper, it is then ready to be entered.

The only field that is editable is the closing field when the number is blue overtype with the new closing stock count.

If an Interim count has been performed and closing stock data is entered, you can use zero closing to remove this.

Particular care should be taken to ensure you have entered in correct units. E.g. litres rather than boxes for postmix, Gallons rather than barrels for draught, Dozens rathen than bottles fo beers/alcopops etc

All stock items should be recorded with accuracy +/- 0.05.

Any products with unit DZ are recorded 'dozens.bottles' eg. 0.01 o dozen and 1 bottle

The software does not permit more than x.11 to be recorded.

0.01

|

0 dozen & 01 bottle |

0.02 |

0 dozen & 02 bottles |

0.03 |

0 dozen & 03 bottles |

0.04 |

0 dozen & 04 bottles |

0.05 |

0 dozen & 05 bottles |

0.06 |

0 dozen & 06 bottles |

0.07 |

0 dozen & 07 bottles |

0.08 |

0 dozen & 08 bottles |

0.09 |

0 dozen & 09 bottles |

0.10 |

0 dozen & 10 bottles |

0.11 |

0 dozen & 11 bottles |

1.00 |

1 dozen & 0 bottles |

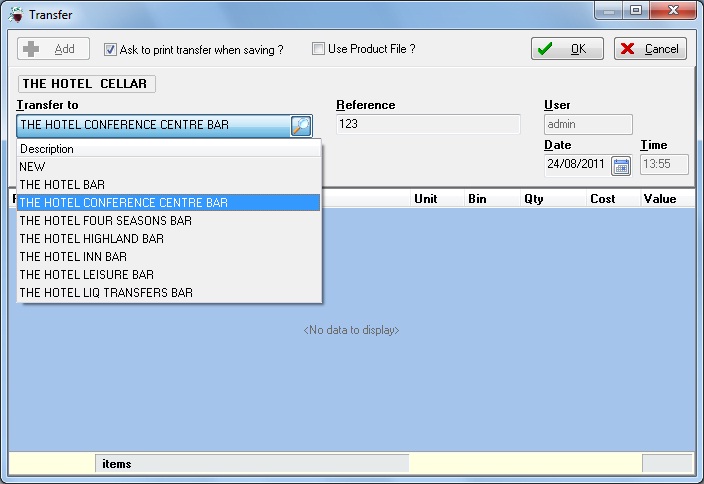

Transfers F11 (Multi-bar sites only)

The transfers button is for multi bar sites only to transfer stock from one bar and into another. This process effectively applies a credit to one bar and a purchase to another.

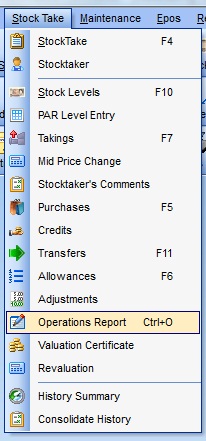

This is used (along with Stocktaker's Comments) to produce a full commentary on the result

First screen: should include details of start & finish times both on and off site as well as next stock (if booked)

Second screen: shows stocktaker's comments

Third screen: shows reports issued as well as spirit tests

Fourth screen: shows standard or group specific questions asked

Fifth Screen: should contain full commentary on the result providing reasons for the result and suggested areas of improvement

If any common words are unknown when the automatic spellcheck runs, you can add these into the dictionary via maintenance -> edit custom spelling

This is designed to be used to make brief comments on any individual bar result and feeds through to the Operations report. More substantial comments should be made on the operations report.